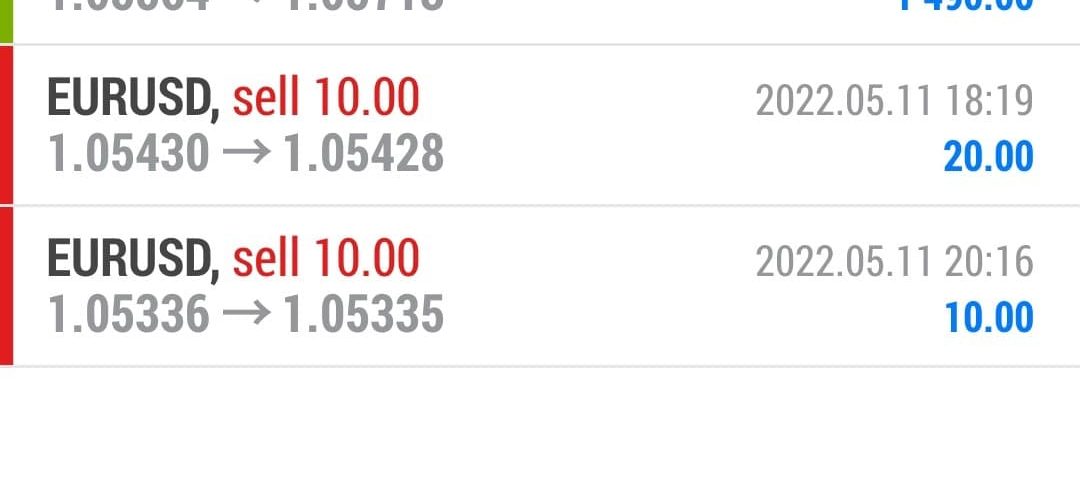

Forex Smart Trade May 11, 2022 – $2,520

Forex Trade Results May 10, 2022 – $2,360

May 10, 2022

Forex Trade Results May 12, 2022 – $2,370

May 12, 2022What are the Advantages of Trading With Variable Spreads?

What are the advantages of trading with variable spreads? Variable spreads eliminate experiencing requotes.

This is because the variation in the spread factors in changes in price due to market conditions.

(But just because you won’t get requoted doesn’t mean you won’t experience slippage.)

Trading forex with variable spreads also provides more transparent pricing, especially when you consider that having access to prices from multiple liquidity providers usually means better pricing due to competition.

What are the Disadvantages of Trading With Variable Spreads?

Variable spreads aren’t ideal for scalpers. The widened spreads can quickly eat into any profits that the scalper makes.

Variable spreads are just as bad for news traders. Spread may widen so much that what looks like a profitable can turn into an unprofitable within a blink of an eye.

Fixed vs Variable Spreads: Which is Better?

The question of which is a better option between fixed and variable spreads depends on the need of the trader.

There are traders who may find fixed spreads better than using variable spread brokers. The reverse may also be true for other traders.

Generally speaking, traders with smaller accounts and who trade less frequently will benefit from fixed spread pricing.

And traders with larger accounts who trade frequently during peak market hours (when spreads are the tightest) will benefit from variable spreads.

Traders who want fast trade execution and need to avoid requotes will want to trade with variable spreads.

Spread Costs and Calculations

Now that you know what a spread is, and the two different types of spreads, you need to know one more thing…

How the spread relates to actual transaction costs.

It’s pretty easy to calculate and all you need are two things:

- The value per pip

- The number of lots you’re trading

Let’s look at an example…

Say, for example, you can buy EURUSD at 1.35640 and sell EURUSD at 1.35626.

This means if you were to buy EURUSD and then immediately close it, it would result in a loss of 1.4 pips.

To figure out the total cost, you would multiply the cost per pip by the number of lots you’re trading.

So if you’re trading mini lots (10,000 units) which is a lot size of .1, the value per pip is $1, so your transaction cost would be $1.40 to open this trade.

The pip cost is linear. This means that you will need to multiply the cost per pip by the number of lots you are trading.

If you increase your position size, your transaction cost, which is reflected in the spread, will rise as well.

For example, if the spread is 1.4 pips and you’re trading 5 mini lots (a lot size of .5), then your transaction cost is $7.00.

Learn to Day Trade

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.