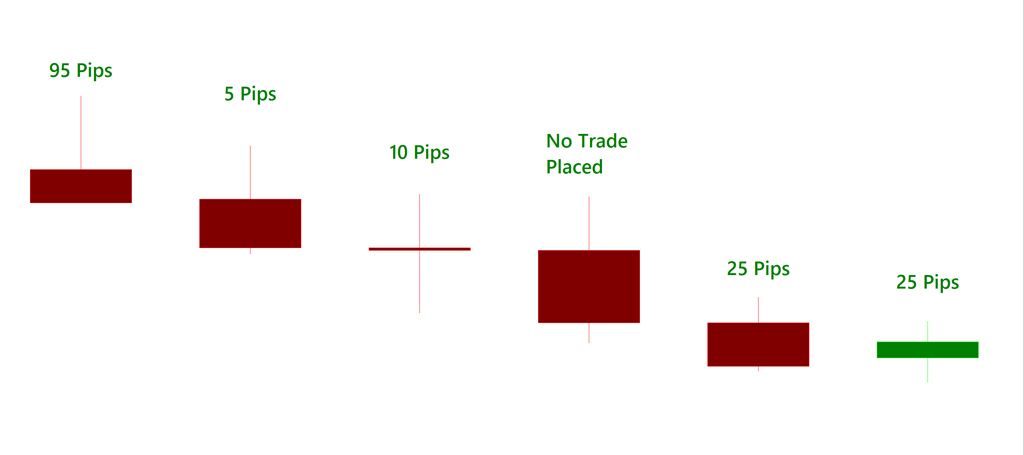

SAT And MIT Trades Taken:

You could have made a profit of $1,600.00 up to $32,000.00

- Sunday SAT Trade: 95 Pips

- Monday MIT Trade: 5 Pips

- Tuesday MIT Trade: 10 Pips

- Wednesday MIT Trade: No Trade Placed

- Thursday MIT Trade: 25 Pips

- Friday MIT Trade: 25 Pips

Total Pips: 160 Pips

If you would have placed the trades during the SAT or MIT you would have made:

- Trading a lot size of 1 ($10 per pip), you would have made $1,600.00

- Trading a lot size of 2 ($20 per pip), you would have made $3,200.00

- Trading a lot size of 4 ($40 per pip), you would have made $6,400.00

- Trading a lot size of 20 ($200 per pip), you would have made$32,000.00

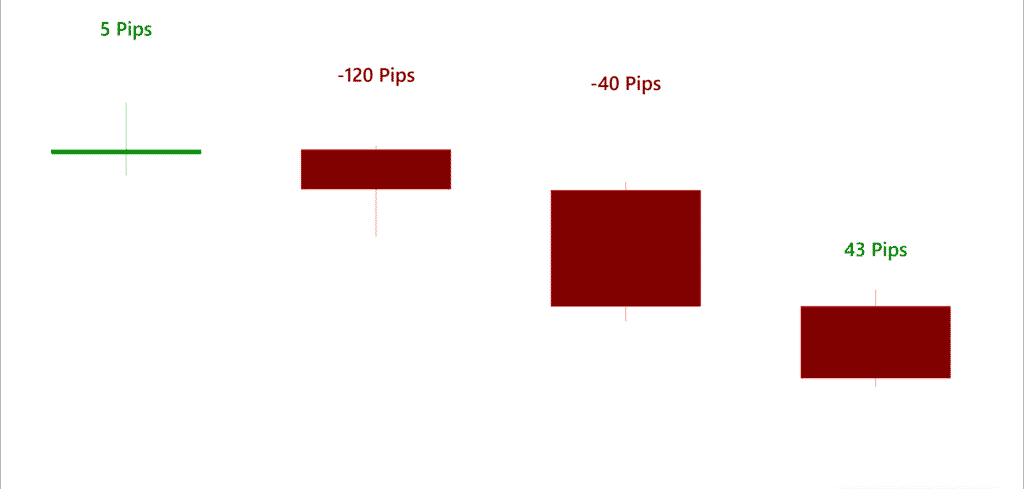

AIT Results:

You could have made a profit of $1,600.00 up to $32,000.00

- Monday AIT Trade: 5 Pips

- Tuesday AIT Trade: -120 Pips

- Wednesday AIT Trade: -40 Pips

- Thursday AIT Trade: 43 Pips

Total Pips: -112 Pips

If you were to have placed these trades during the AIT Trades, you would have made:

- Trading a lot size of 1 ($10 per pip), you would have made $1,600.00

- Trading a lot size of 2 ($20 per pip), you would have made $3,200.00

- Trading a lot size of 4 ($40 per pip), you would have made $6,400.00

- Trading a lot size of 20 ($200 per pip), you would have made $32,000.00

Disclaimer

The pip total may not include additional trades, losses, or hedges. The trades taken are an example of what is possible. Not all traders will experience the same results. Each customer is able to attend the daily webinars showing the trade examples. In this way you will be able to see the potential of the market for you individually.

Futures and options trading is speculative and involves substantial risk of loss. Past performance is not indicative of future results.

IMPORTANT NOTE: Trading foreign exchange or futures on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange or futures, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange and futures trading, and seek advice from an independent financial adviser if you have any doubts or questions. Past trading history does not indicate future trading success.

Total Pips: May 12th - May 17th, 2019

PIPS

*Futures, options, and forex trading is speculative and involves substantial risk of loss. Past performance is not indicative of future results. IMPORTANT NOTE: Trading foreign exchange or futures on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange or futures, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange and futures trading, and seek advice from an independent financial adviser if you have any doubts or questions. Past trading history does not indicate future trading success.